Last time in our Creative Accounting series, we discussed how important it is to keep track of every expense related to your creative small business. Today, we’ll zoom in on a particular category of your expenses, called “overhead”.

No, I’m not talking about you buying an overhead projector. Overhead is a term used in cost or manufacturing accounting (sounds scary? it is!). Your overhead expenses are all the expenses you incur to design, create, or manufacture your product, but they are not directly traceable to an individual product.

If you were running a giant factory and creating widgets, your overhead expenses would be things like the rent, utilities, wages to pay your factory workers, insurance, marketing fees, advertising, tools, machines, and indirect materials. These are all costs that are vital to keeping your business running. Without them, you would not be in operation, but you can’t exactly trace them to your finished products…like how much of your electricity bill helped generate that one widget? I’m sure with some complicated formula we could figure that out, but we don’t have time for that. We’ve got stuff to make!

Your handcrafted small business has overhead expenses too. You probably spend money on lots of things that keep your business running smoothly, yet these expenses are not directly, easily traceable to every item you create. If you go back to the last post about your business’ expenses, the expense categories like indirect supplies and materials costs, tools, machines and other items used, and all of the non-product costs should be considered overhead expenses for your business.

In my humble opinion, one of the biggest mistakes Etsy entrepreneurs make is not taking these overhead expenses into account when pricing their goods. Like we mentioned in the past post, most of these expenses are deductible for tax purposes, but you should also try to recoup a little piece of your overhead expenses in every sale you make. I’m not going to talk about pricing formulas and those specifics today, but the point is you need to be thinking of the most sensible way to include a tiny portion of your overhead expenses in the price of each and every item you list for sale.

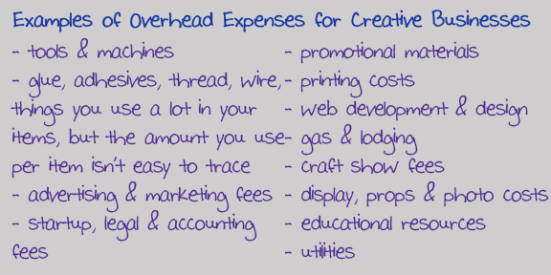

How do you go about doing that? Well, I’d start by tallying your estimated overhead expenses, either on a monthly or annual basis, whatever is easiest for you. That includes the following types of expenses:

Once you get to an annual estimated total of these expenses, you need to find a way to work backwards to include a piece of this total sum in your pricing formula. There are lots of ways to do this. Here are just a few possibilities:

- Estimate how many products you will create this year. Take your total overhead expense number and divide it by the number of items. Add that number to the sales price of each item you list for sale. For example, $1000 in annual overhead divided by making 350 items this year means I need to increase the price of each item by $2.85 or so to recoup a chunk of overhead in every sale I make.

- Same method as above, but instead of estimating your total items produced, estimate the total number of items you hope to sell this year. That way you are getting closer to truly recouping that overhead expense back with each and every sale.

- Instead of adding a flat “fixed” overhead dollar amount to each sale price, you can use a percentage markup instead. Once you know the cost of direct materials and labor that went into creating a specific product, you might multiply that total by a specific overhead percentage (determined based on what feels sensible to you). For example, if these earrings cost me $6 to create and my overhead percentage is 20%, then I’m saying that product required about $1.20 of overhead expense to make, and really cost me $7.20 in total to create.

All overhead methods have their pros and cons. Using a fixed flat overhead rate is easiest, but using the same rate across the board for every product you make might not be best representing your true overhead costs per product. On the other hand, the percentage method allows you to add more overhead costs to your more expensive or time-consuming products, which probably really do use more overhead expenses. It all depends on what makes sense to you. The important thing is that you try to do something to include these costs somewhere in your pricing formula. If you don’t, you are much less likely to ever recover those expenses, and at the end of the day, your business is making less real profit than you might think. So get cracking on thinking about overhead!

I’d love to hear from you! What do you think is the most challenging part about bookkeeping for your handmade business?

Related articles

- Financial Records for My Creative Business: Keeping Track of Expenses (lazyowlboutique.com)

- Crafting a Business 101: Creative Accounting (lazyowlboutique.com)

- TurboTax – Which Receipts Should I Keep for Taxes? (turbotax.intuit.com)

Janet, you’re kind of an accounting genius, you know that? Thanks for these tips! I always grow a little bit more when I read your articles!!

Very helpful article. I just started my etsy shop about a year and a half ago and am still not making a whole lot of money yet, so this is very helpful.

cabinofbows.blogspot.com